BELLEFONTE — The Volunteer Income Program offers free certified tax help and electronic filing for individuals with income of approximately $65,000 and below. Volunteer preparers are trained each fall, and there are enough of those for this tax season.

However, there is still a need for intake volunteer workers to greet clients and help set up their tax appointments. Also, phone schedulers are still needed. In that volunteer position, you would answer the phones in the Retired Senior Volunteer Program office at 420 Holmes St., Bellefonte. Volunteers for the phone scheduling are needed on Mondays, Wednesdays and Fridays starting in February.

Ashley Brownson, RSVP assistant, trains the schedulers in the RSVP office. If interested, please call Brenda Reeve, RSVP project coordinator, in the RSVP office at 814-355-6816.

Anyone with a W-2 form who makes up to $65,000 can receive tax prep help through VITA. Penn State students can come for help too. The program also can do out-of-state forms. There is no in-person contact with the preparers. The clients wait in a reception area and then the preparers review the return with them.

In a recent Office of Aging meeting, Brian Meader, a tax preparer trainer, said, “In 2023, we prepared 1,800 tax returns. Our programs are open all year and the government provided the software that we used for training.”

Quentin Burchfield, director of the Office of Aging, said, “Brian Meader and Boyd Spicher are both so dedicated to the VITA program. They have trained income tax preparers for years and are available for questions even in the off season.”

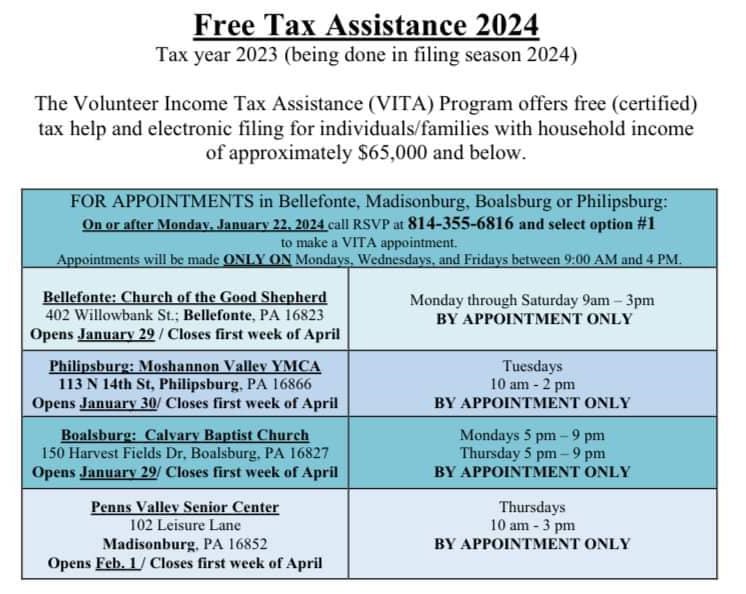

To schedule a tax appointment in Bellefonte, Madisonburg, Boalsburg or Philipsburg, call RSVP at 814-355-6816 and select option 1 to make an appointment. In Bellefonte appointments will be at Church of the Good Shepherd, 402 Willowbank St.; in Philipsburg at Moshannon Valley YMCA, 113 N. 14th St.; in Boalsburg at Calvary Baptist Church, 150 Harvest Fields Drive; and in Madisonburg at Penns Valley Senior Center, 102 Leisure Lane.

What is required:

- Photo ID such as driver’s license, school ID, state ID.

- Social Security cards and birth dates for you, your spouse and dependents.

- Income documents: W-2, W- 2G, 1099-R, 1099-Int, 1099-Div, 1099-Misc, etc.

- A copy of last year’s federal and state returns if available.

- Bank routing numbers and account numbers (if you want direct deposit/debit).

- To file taxes electronically for a married-filing-joint tax return, both spouses should come in.

- Bring a rent certificate from your landlord and/or paid property tax receipts to see if you qualify for the Pa-1000 Property Tax/Rent Rebate.

Spicher and Meader have contributed for many years to the tax program by training tax preparers. In the fall each year, they have provided training once a week for four weeks, and then a couple more days in January to make sure the preparers are ready. All preparers are IRS certified.

The VITA program answers tax questions even after the filing time is over.

There are many nonprofits that are under the RSVP umbrella, and they all need volunteers. Reeve said, “Our volunteers make a difference, one volunteer at a time. It’s our motto.” She said that RSVP is different than many other nonprofits. RSVP interviews prospective volunteers and attempts to fit each person with a nonprofit where they can feel useful and comfortable.

There are 800 RSVP volunteers in Centre County and 70 nonprofits. Centre County RSVP is supported in part by the Corporation for National & Community Service and by the Centre County Board of Commissioners through the Office of Aging. As an RSVP volunteer, you will receive free volunteer placement. You can use your experience and skills in a meaningful way to help your neighbors. You will learn something new and provide help in multiple ways. RSVP has supplemental accident and liability insurance that covers what your own insurance does not in case of an accident while volunteering. There are many one-time event opportunities to help at nonprofits as well as weekly or monthly commitments.